Commerce Bank

Company Snapshot

Commerce Bancorp (aka Commerce Bank, and now called TD Commerce Bank) is a subsidiary of Toronto-Dominion Bank that offers banking, insurance, brokerage, and investment banking services to consumers, commercial, and government customers. Prior to being acquired in early 2008, Commerce operated in a number of East Coast states including Pennsylvania, Delaware, Connecticut, New York, New Jersey, Maryland, Washington D.C., Virginia, and Florida.

Blue Ocean Strategic Move

Commerce Bank was founded in 1973 by Vernon Hill who looked across industries to fast-food restaurants to create a blue ocean opportunity in banking. He decided to call his branches "stores" and developed a business model focused on maximizing customer convenience and delivering consistently great customer experiences.

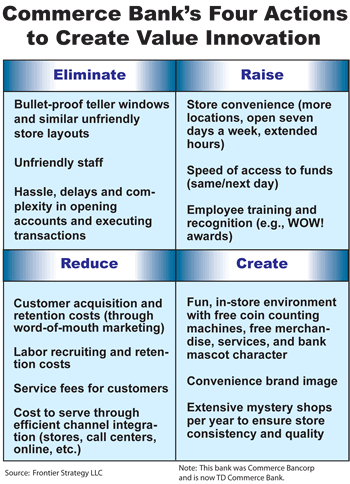

In contrast to our other Blue Ocean banking example (ING Direct), Commerce Bank invested heavily in store facilities and personnel to make the customer experience great and didn't focus on having the best rates. To increase convenience, stores were kept open seven days a week and hours were extended in the mornings and evenings. Also, customers were able to get instant ATM cards, and funds from their deposits would be credited either the same day or the next day. For fun, the bank offered free coin counting machines and gave customers free merchandise such as pens and even dog biscuits. Employees were carefully recruited and trained and competed for WOW! appreciation awards. Through all of these efforts, the bank has been able to reduce the costs of acquiring and retaining customers and deposits as well as its staffing costs. In one of the biggest red ocean industries, Commerce Bank created a blue ocean from within with mass customer appeal and a business model based on some of the best practices of speed, convenience, and friendly service from the fast-food industry.

Success

Commerce Bank created a tremendously successful retail banking business model that has resulted in significant store expansion and profitable growth. By 2007, prior to being acquired by Toronto Dominion Banknorth for US$8.5B, the company had grown to 470 stores with revenues of $1.93 B USD and net income of $140 million USD.